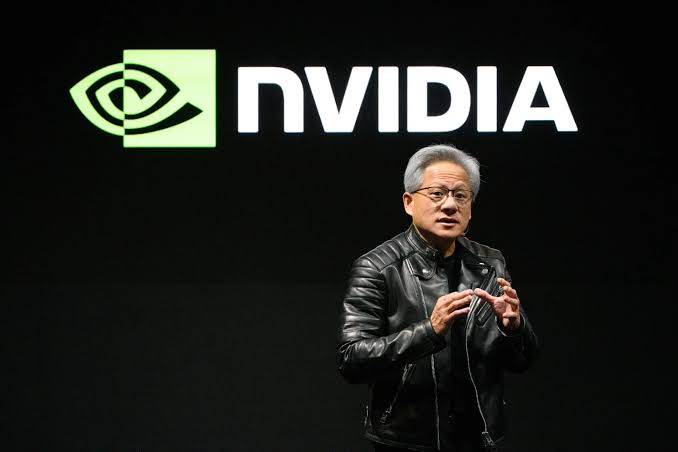

AI powerhouse Nvidia announced its quarterly earnings on Wednesday, August 27, surpassing expectations; however, shares declined due to worries about a potential AI chip spending bubble and the company’s stagnant business in China.

The California-based company reported a profit of $26.4 billion on record revenue of $46.7 billion for the recently concluded quarter, spurred by strong demand for chips from leading tech firms that support AI datacenter computing.

Despite a significant year-over-year increase in overall revenue, revenue from Nvidia’s Data Centre compute products, including its highly sought-after graphics processing units (GPUs), fell by 1 per cent compared to the previous quarter.

This decline was attributed to a $4 billion drop in sales of H20 chips—specialised processors designed for the Chinese market, as noted in the earnings report.

Also Read: Federal Government Expands 3MTT to Create Jobs Through Outsourcing

For the upcoming quarter, Nvidia has forecasted $54 billion in revenue but indicated that this projection does not include any H20 sales.

Nvidia’s premium GPUs continue to be in high demand from tech giants constructing data centres for artificial intelligence applications. Nevertheless, investors are questioning the sustainability of these substantial AI investments.

“The data centre results, while impressive, indicated that hyperscaler spending might tighten at the margins if short-term returns from AI applications remain challenging to measure,” stated Emarketer analyst Jacob Bourne.

“Simultaneously, US export restrictions are promoting domestic chip production in China.”

Nvidia shares experienced a slight decline of over 3 per cent in after-market trading.