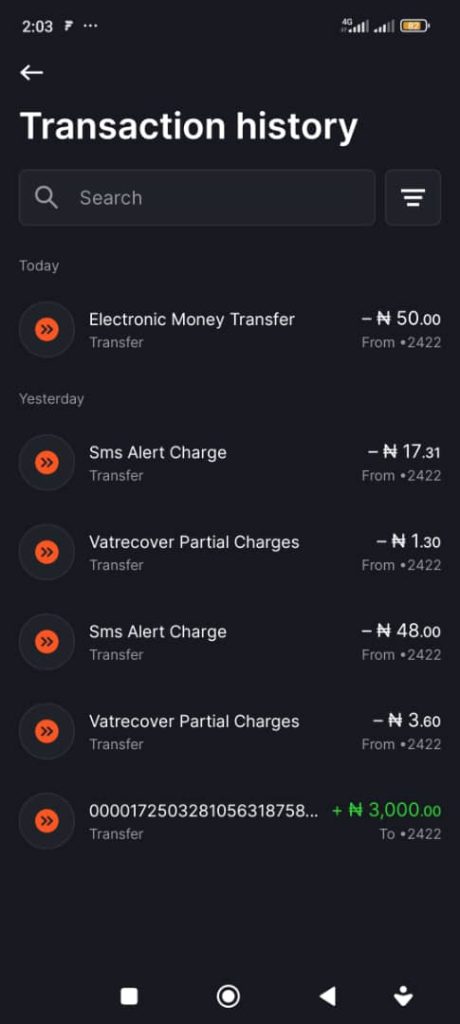

Bank customers in Rivers State have accused financial institutions of unfair deductions and excessive charges, leading to widespread frustration and allegations of electronic theft.

Many customers claim that banks are making unauthorized deductions from their accounts without proper explanations. They say the situation is worsening, with frequent and unjustified debit alerts.

Speaking to our correspondent, Rachel Princewil, a Port Harcourt-based lawyer, described the deductions as “electronic stealing.”

“It is something that needs to be checked and stopped. While some of these charges are reversed, many are not. I personally have not experienced them, but my son has been lamenting about frequent debit alerts from his bank. From what I have gathered from others, it is really frustrating,” she said.

She urged customers to demand explanations from their banks and push for regulatory intervention.

A labour union leader, Comrade Innocent Lord-Douglas, also condemned the trend, warning that it could drive people back to the old habit of keeping money at home, which could negatively impact the economy.

“What we are noticing from the bank now is actually disappointing; there are issues that is difficult to phantom. Most of these charges are not negotiated at all, and there is no information about the charges.

“This is happening in the sense that you may feel you have a certain amount in the bank only to discover that their charges have eroded your money.

“The excessive charges are discouraging people from saving in banks. Many are beginning to prefer storing money at home, which is dangerous. If this continues, we might see an increase in burglary cases, as was common in the past before the cashless economy policy.”

Also Read: Rivers Drivers Say Emergency Rule Has Negatively Affected Their Business

He also criticized the banking sector unions for their silence on the issue, stating that they should take action to protect customers.

“The unions in the banking sector should rise to the occasion. They cannot claim to be unaware of customers’ complaints. They must demand accountability from banks and work towards a resolution.

“As it stands now, nobody has heard anything from the Union in charge of the banking sector.”

He called on the government and financial regulators to step in and address the issue.

Business owners have also voiced their dissatisfaction, arguing that savings accounts no longer serve their original purpose of generating interest. Instead, they say they are losing money due to various charges.

A business owner, Innocent Chimereucheya, attributed the excessive charges to regulatory failures.

“A savings account is supposed to help you grow your money, but now banks deduct various charges, including SMS fees and card maintenance fees. Some people do not even use their debit cards for a whole month but are still charged maintenance fees. It is frustrating,” he lamented.

Many customers are now urging the government to intervene and hold banks accountable. They are calling on the Nigeria Deposit Insurance Corporation (NDIC) and other regulatory bodies to investigate these charges and ensure transparency in banking transactions.