Tina Amanda

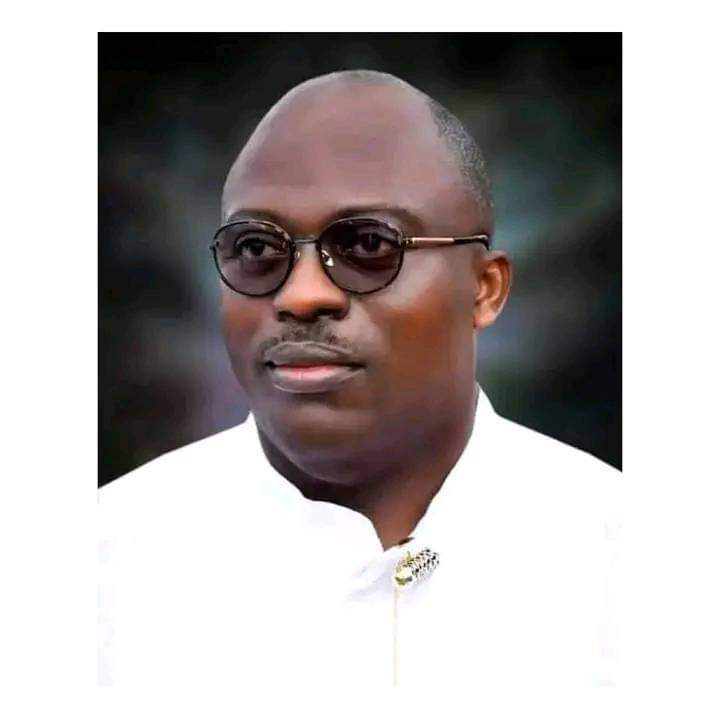

A Civil Society Organisation has urged the incoming Governor of Rivers State Siminalaye Fubara, to digitize the tax payment system, and end all forms of human rights abuses associated with tax collection.

Coordinator of Rivers State Tax Justice Governance Platform and the Executive Director, Community Consolation Development Initiative, Amaechi Kelechi, stated this during a workshop training on taxation for youths and entrepreneurs in Port Harcourt, organsied by Civil Society Legislative Advocacy Center (CISLAC).

According to him, a digital tax payment system is on the trend in Nigeria as states like Lagos, and Anambra have digitalized their tax payment system, and it is helping them generate more tax for the work they have to do, noting Rivers State can not be an exception to the new innovation.

He explained that it will be much easier to pay tax through the digital process as it allows people to know the place or person to pay, adding that it affords convenience.

“In the cause of our work as promoters for fair and progressive tax under the Fair for All Power of Voices partnership initiative funded by Oxfam and Nigeria.

“We are advocating that the incoming Governor Similaye Fubara should digitalize the tax payment system that way it will bring an end to multiple taxation, incident of tax practices that abuses human rights.

“It will restrict civic space, it will help simplify and harmonies the tax code system, to enable more people to respond and comply with their taxes.

“That is the trend in some states in Nigeria, as Lagos, and Anambra have digitized their tax payment system.”

Speaking further, Kelechi said: “The incoming government should look at it critically and adopt it. As a non-profit organization, we frown at the rights abuses when tax collectors go to collect tax whether at the local government level where levies are collected especially at the market. The goods of women are destroyed and sometimes, these women get wounded because they are violently attacked in the process of tax collection.

“So when you digitalize the tax ecosystem in the State, you would have eliminated all the issues about violent, deaths, multiple taxation, the unwillingness of people to pay tax. It becomes easier and convenient for people to pay from the comfort of their offices or homes through a digital card.”

He further noted the process will enable more people to be stimulated in paying taxes and compliance will definitely increase.

Also, the State Chairman of Nigeria Hotel Association, Okey Ekweanua, said the tax digitalized system will eradicate the multiple taxation they pay, stressing that they are compelled to pay for value-added tax, liquor license tax, consumption tax, and several demand notices from different quarters which amount to same payment.

Ekweanua said that multiple taxation is actually a crime and they have severally gone to court as a body to contest it, yet nothing was done about it.

“Am so happy for the organisers of this program, it has enlightened me more. We pay VAT, liquor license tax, and consumption tax which are all multiple taxation. You cannot be asking me to pay value-added tax at the same time telling me to pay consumption tax when VAT payment should have covered all of that.

“A lot of tax here and there, and demand notice from different quarters, and they have made us know that some of these demand notices are not for the appropriate offices.”